Please tell us where you bank so we can give you accurate rate and fee information for your location.

Auto Loan Calculator

- Lock in your rate

- Apply now

Page unavailable. We're sorry, the Bank of America page you are trying to reach is temporarily unavailable. We apologize for the inconvenience.

Estimate your monthly car loan payment

Enter a total loan amount into this auto loan calculator to estimate your monthly payment, or determine your loan amount by car price, trade-in value and other factors.

Results shown are for . Change your state

The figures entered on the input page of this calculator are for hypothetical purposes only. You should enter figures that are appropriate to your individual situation. The results provided by this calculator are also intended for illustrative purposes only and accuracy is not guaranteed. Bank of America and its affiliates are not tax or legal advisers. This calculator is not intended to offer any tax, legal, financial or investment advice and does not assure the availability of or your eligibility for any specific product offered by Bank of America, its affiliates or any other institution, nor does this calculator predict or guarantee the actual results of any investment product. The terms and conditions of products offered by institutions will differ and may affect the results of the calculator. Please consult with qualified professionals to discuss your situation. The final APR may differ from the APR in the above results due to additional fees that may be applicable.

Select Your State

The Preferred Rewards program is our way of rewarding you for what you already do, members can get an interest rate discount adatext of

0.25%

Gold Tier

0.35%

Platinum Tier

0.50%

Platinum Honors Tier and higher

Thinking about refinancing?

Car shop with confidence

Get prequalified adatext to make your car decision easier.

- No impact to your credit score

- Search for cars that fit your price range

- View your estimated loan terms

Bank of America login required.

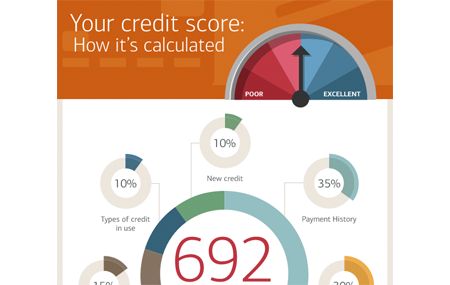

Your credit score affects your auto loan

One of the main factors lenders consider when you apply for a loan is your credit score. A higher score can help you secure a better interest rate—which means you'll have a lower monthly car payment.

Get more with Bank of America auto loans

Get more with Bank

of America auto loans

60-second decision (for most applicants) with a 30-day rate lock adatext

Know how much you can afford before you shop

Manage all your BofA accounts in one place